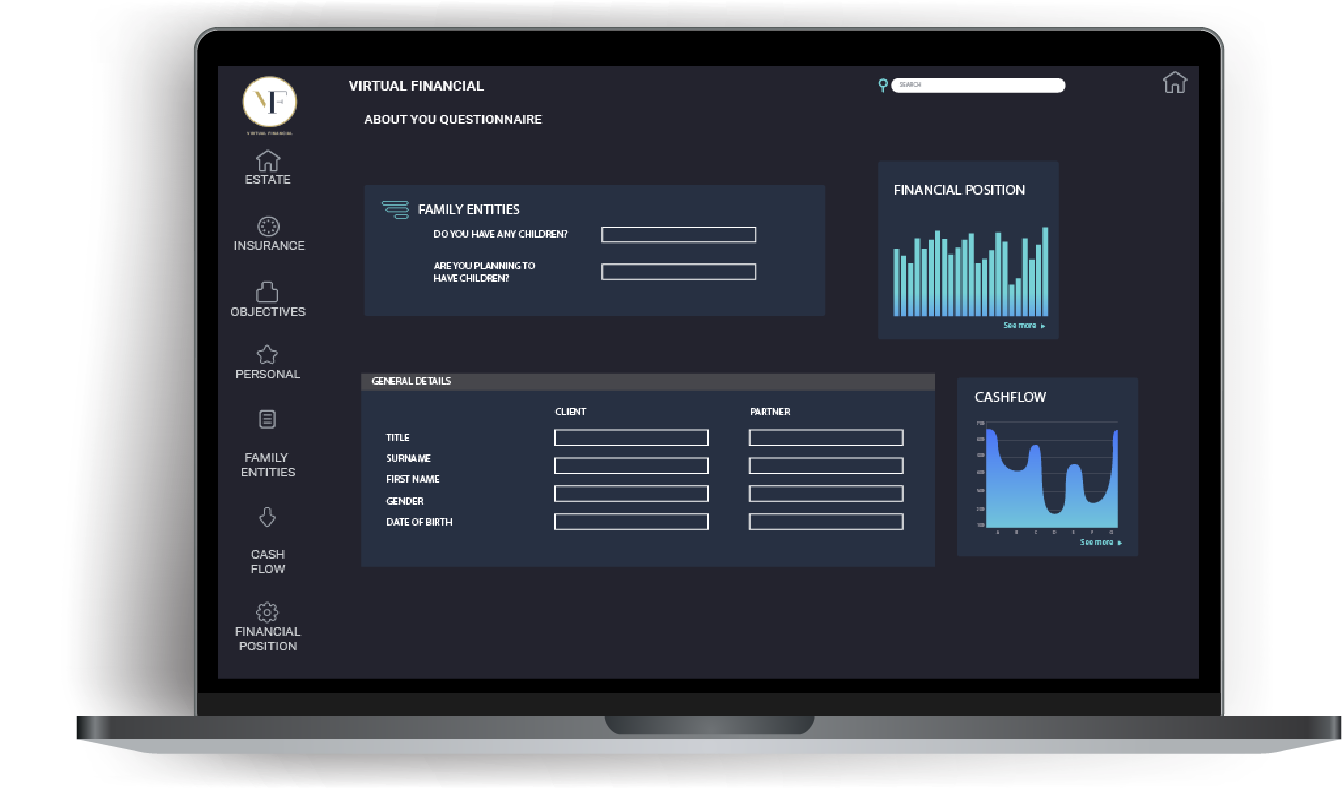

Use the tools below to help you understand you’re finances better and know the next steps to take to unlock your financial future.

This information is general advice and does not take account of investors’ objectives, financial situation or needs. Before acting on this general advice, investors should therefore consider the appropriateness of the advice having regard to their objectives, financial situation or needs. The results from this calculator are based on the limited information that you have provided and assumptions made about the future. The amounts projected are estimates only and are not guaranteed. Do not rely solely on this calculator to make decisions about your retirement. There may be other factors to take into account. Consider your own needs, financial situation and investment objectives.

If you want to ease into retirement by reducing your hours and working part-time, you can maintain your lifestyle by using some of your super to top up your income through a Transition to Retirement Pension (TRP). The key benefit of the strategy is to draw income from the TRP to replace the employment income.

Our financial planning services can help you develop a strategy to increase your investments, reduce your debts and plan for your retirement.

We help our clients understand what super strategy is best for them. This includes maximising your retail super or setting up & managing your self managed super fund.

Is your wealth protected from unexpected circumstances? We ensure you have all the required insurances to protect you from sickness, trauma and death.

Our financial planning services can help you develop a strategy to increase your investments, reduce your debts and plan for your retirement.

We help our clients understand what super strategy is best for them. This includes maximising your retail super or setting up & managing your self managed super fund.

Is your wealth protected from unexpected circumstances? We ensure your have all the required insurances to protect you from sickness, trauma and death.

Adem Becirevic Authorised Representative No. 244661 | Virtual Financial Group Pty Ltd | ACN 106472833 | Corporate Authorised Representative No. 363528 | Shartru Wealth Management Pty Ltd | AFSL 422409 | ABN 46 158 536 871

General Advice Warning

This website contains information that is general in nature. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decisions based on this information